Banking on trust: The rise of predictive financial care

What's happening?

Banking’s evolution: From reactive to predictive

Then: Reactive service

Traditional banks built credibility through institutional presence and standardized processes. AI was used as an efficiency tool first and foremost rather than a long-term relationship builder, with limited personalization based on broad segments. Financial guidance was mostly reactive and generic.

Now: Intelligent automation

A split emerges between institutions using AI merely for automation versus those leveraging it for genuine customer insight, providing personalized guidance at scale. Digital tools are used to simplify complex financial decisions, with more focus on proactive support.

Next: Predictive care

By 2027, financial services AI spending is projected to reach $97 billion, tripling 2023 figures. Automation and traditional human service will evolve in tandem to create a new model of relationship intelligence in which AI amplifies and enhances human judgment to enable truly predictive financial care at scale.

Why is this happening?

The AI trust paradox

AI is forcing a radical redefinition of trust for banking brands, with institutions facing a stark choice. As the technology unlocks new personalization tools that will improve the customer experience at scale, they also have to reckon with the fact that 43% of customers actively distrust AI tools for financial management.

"Organizations spent a good part of last year identifying different use cases for AI," observes Ashvin Parmar of Capgemini. "Very quickly, they looked beyond productivity and cost-cutting to ask: 'How do I use this pivotal technology to transform my business and create a better customer experience?'"

Changing customer relationships

The industry’s shift towards AI-driven personalization is part of a broader transformation in how financial relationships are formed and maintained. RFI Global's MacroMonitor data reveals that bank-switching rates in the US have jumped from 20% to 25% over the past decade, reaching 30% among millennials. Meanwhile, neobanks have surpassed traditional institutions in UK app downloads, with three leading fintechs now controlling over 10% of primary banking relationships in the US.

The rise of invisible banking

The rise of embedded finance and Banking-as-a-Service models further accelerates this transformation. Financial services are increasingly woven into non-financial platforms and experiences, from ride-sharing apps to social networks. This “invisible banking” trend requires institutions to maintain brand relevance even as their services become more seamlessly integrated into customers' daily lives. Nearly half of organizations using AI for personalization have found measurable positive impacts on revenue, productivity, or margins — yet only 12% cite best-in-class data quality for AI applications.

The human equation

While automated services gain traction, the human element remains crucial. Investment News reports that 72% of Gen Z find it difficult to talk about their finances, with only 7% feeling comfortable discussing money matters with apps. This reveals a critical gap between technological capability and emotional trust that financial brands must bridge. Adding to the complexity, only half of marketers have complete awareness of potential AI-related risks, with just one in eight having a strategy in place to address future risks.

Regulatory pressure

The industry also faces mounting pressure from regulatory changes. Open Banking initiatives rolling out between 2025 and 2027 will make switching providers nearly frictionless while growing scrutiny of AI in financial services pushes institutions to develop more transparent and accountable automated systems. For brand leaders, this creates urgent new imperatives around trust-building and customer retention.

Success in this new landscape requires evolving from reactive service providers into proactive financial caregivers — balancing automated intelligence with authentic human connection. Financial brands must not only predict and meet customer needs but do so in ways that build, rather than erode, trust.

How is this happening?

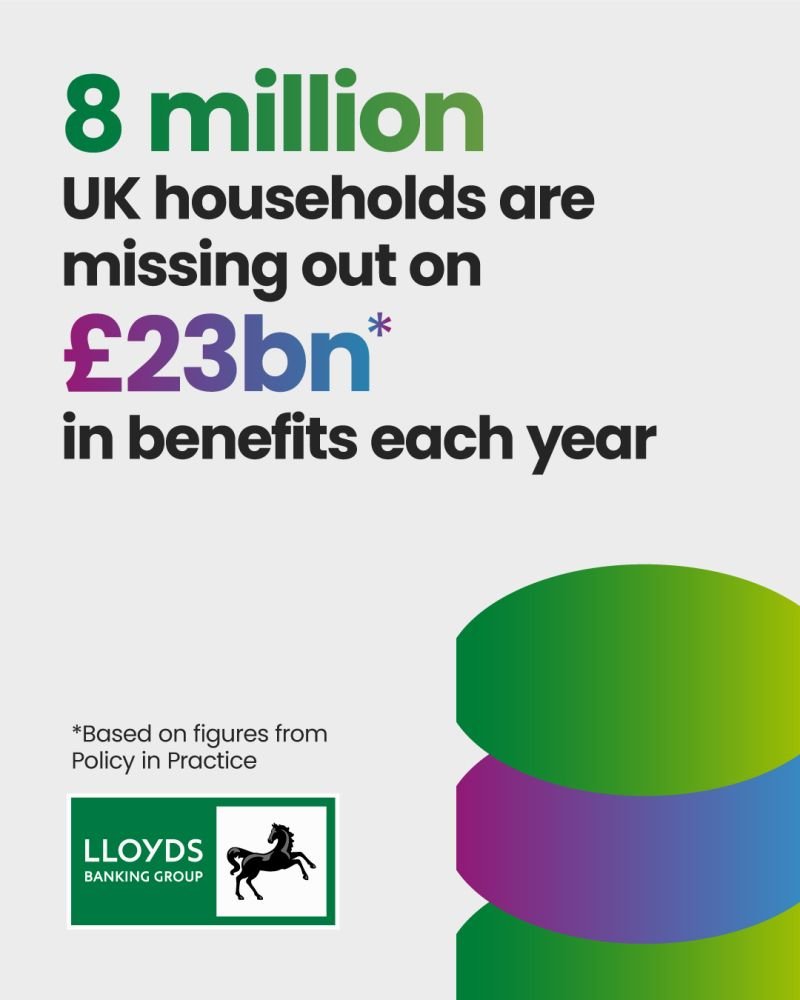

With 85% of its 27 million customers engaging digitally, Lloyds faces intense pressure to personalize at scale while maintaining trust. Its response centers on its Digital Waterfront initiative, transforming digital banking from transaction management to holistic financial planning.

"Our strategy is about showing what tomorrow looks like for our customers and the steps they can take now to future-proof their finances," says Amit Thawani, Chief Information Officer for Insurance, Pensions, and Investments. The Digital Waterfront provides AI-powered insights across banking, savings, investments, and pensions, with features like Ready-Made Pension simplifying retirement planning.

Lloyds Banking Group: Visualizing tomorrow's finances

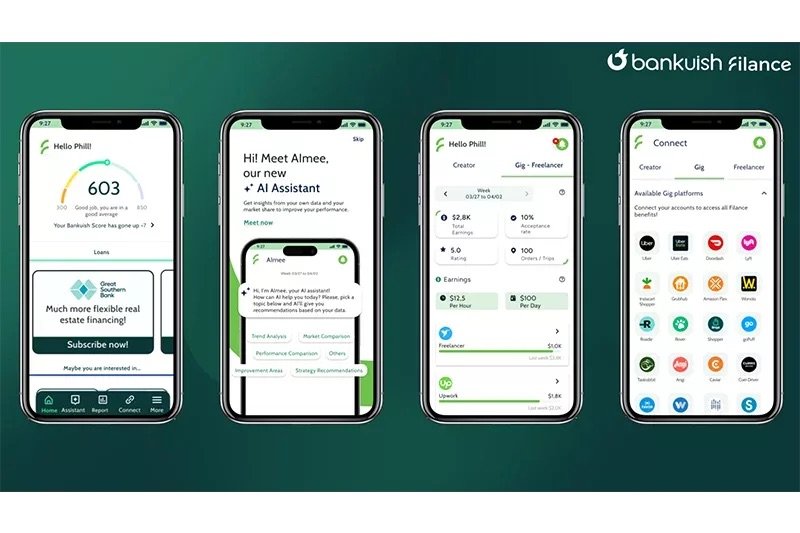

Since 2020, Bankuish has pioneered predictive analytics to expand financial access for gig economy workers. Its AI assistant AImee analyzes non-traditional data points — from delivery completion rates to customer ratings — to help traditional banks assess creditworthiness beyond conventional metrics.

Bankuish currently serves the Latin American and US markets, with AImee providing actionable insights into performance metrics such as earnings trends, acceptance rates, and productivity benchmarks. "By 2028, we aim to be the preferred credit bureau for most major banks to assess the creditworthiness of the future of work," founder José Fernández told 4YFN.

Bankuish: Fintech security for the gig economy

Cleo combines practical financial tools with an engaging personality. The app uses AI to analyze spending patterns for personalized budgeting advice, while its conversational interface uses humor and casual language to make finance more approachable. “Using the bank data and what you've said to us, Cleo will be your kind of confidant or coach,” says Barney Hussey-Yeo. “She'll provide the right advice and the right products to help you make better financial decisions.” However, Wired notes that Cleo's monetization strategy highlights key tensions in automated financial care, particularly its promotion of cash advances during moments of financial stress.

Cleo AI: Speaking Gen Z's language

What’s next?

- Natural language banking will become mainstream, requiring distinctive AI brand voices across millions of daily interactions

- New Open Banking regulations will enable near-frictionless provider switching

- Growing regulatory oversight of AI in financial services will demand increasingly stringent standards for transparency and accountability

- Rising competition from embedded finance platforms will intensify pressure on traditional banks to evolve or risk becoming “just warehouses for deposits”

Future implications: Strategic considerations for brand leaders

Evolution of trust signals

The mechanics of trust-building in financial services are being fundamentally redefined. Brands need transparent data practices that build emotional resonance. For CMOs, this means evolving brand communications to emphasize how data powers personalization rather than just highlighting features. CTOs should prioritize explainable AI systems that can demonstrate how decisions are made.

Business model revolution

Financial brands must evolve beyond traditional product-first thinking toward ultra-personalization. As consumers seek specialized providers for specific needs, this creates opportunities for brands to serve as platforms or ecosystems, not just service providers. CMOs should focus on communicating value in specific use cases, while CTOs build flexible architectures to support rapid service evolution.

The new human element

Rather than replacing human interaction, automation is enabling its reinvention. By 2029-30, Craft Innovations forecasts that some institutions will offer AR/VR branch experiences blending digital efficiency with human connection. Brands must find ways for AI systems to amplify rather than replace human expertise, focusing on emotional intelligence alongside technical capability.

The transformation from reactive to predictive financial services is more than a technological shift — it's a fundamental reimagining of the banking relationship. Brands must find a delicate balance between automated efficiency and authentic human connection in experiences that feel both cutting-edge and deeply personal.